Smart Investing | Building a Secure Financial Future

In this article, we’ll explore the world of investing and provide you with valuable insights to help you make informed decisions. Let’s dive in!

Why Invest?

Investing is not just for the wealthy; it’s a financial strategy accessible to everyone. By putting your money into various investment vehicles, you have the opportunity to grow your wealth over time. Whether you’re saving for retirement, a down payment on a home, or your child’s education, investing can help you reach your financial goals.

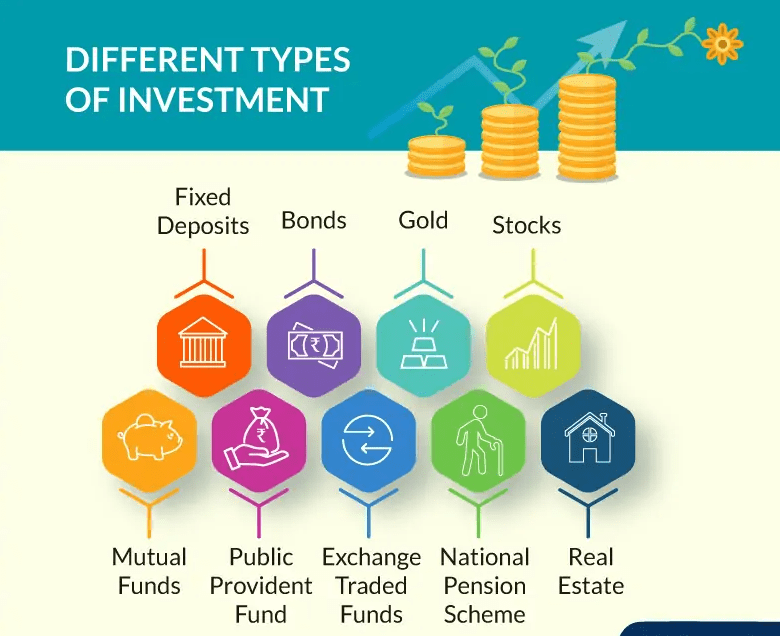

Types of Investments

There are various types of investments to consider:

- Stocks: Investing in individual company shares offers the potential for significant returns. However, it also comes with higher risk due to market volatility.

- Bonds: Bonds are lower-risk investments, typically offering fixed interest rates. They are a suitable choice for more conservative investors.

- Real Estate: Investing in real estate can provide rental income and property appreciation over time.

- Mutual Funds: These funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs offer diversification but are traded on stock exchanges like individual stocks.

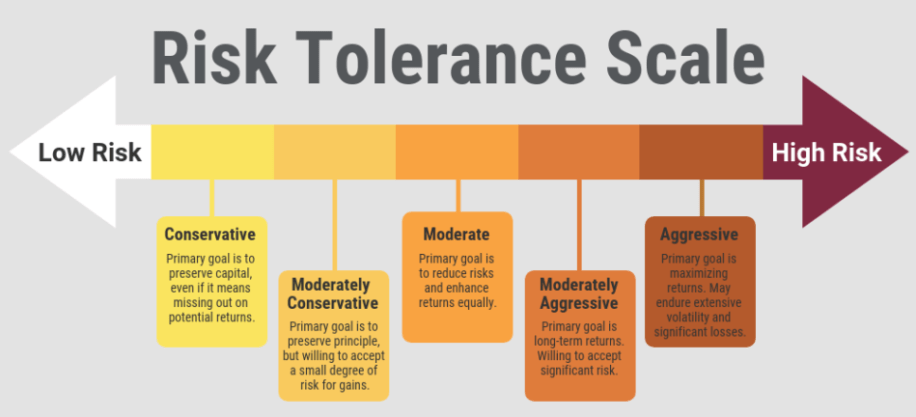

Risk Tolerance and Diversification

Your risk tolerance is a crucial factor in your investment decisions. It’s essential to strike a balance between risk and potential reward. Diversification, spreading your investments across different asset classes, can help manage risk. Ensure your portfolio aligns with your risk tolerance and long-term goals.

Time Horizon and Goals

Consider your time horizon when investing. Short-term goals, like buying a car, may require less risk in your portfolio. Long-term goals, such as retirement planning, can accommodate more aggressive investments with higher potential returns.

Research and Education

Before investing, educate yourself about the investment options available. Stay informed about market trends, economic news, and the performance of your investments. Knowledge is your best ally in making sound investment choices.

Consult a Financial Advisor

If you’re unsure about where to start or need personalized advice, consider consulting a financial advisor. They can help you create an investment strategy tailored to your financial situation and goals.

Monitor and Adjust

Regularly review your investment portfolio and make adjustments as needed. Market conditions change, and your financial goals may evolve over time. It’s essential to ensure your investments align with your current objectives.

Conclusion

Investing is a journey that can lead to a more secure financial future. By understanding your risk tolerance, diversifying your investments, and staying informed, you can make smart decisions that align with your goals. Remember, investing is about the long term, and patience can be one of your greatest assets in building wealth. Start today, and watch your financial future flourish.